37+ mortgage interest itemized deduction

Web Itemized deductions for 2022 include Mortgage Interest State and Local taxes up to 10000 including property taxes medical expenses in excess of 75 of your. Secured by that home.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

MIDs value to taxpayers depends on their marginal tax rate.

. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web A home mortgage interest deduction is an itemized deduction that allows homeowners to deduct any interest on loans that are used to build improve or purchase. Homeowners who bought houses before.

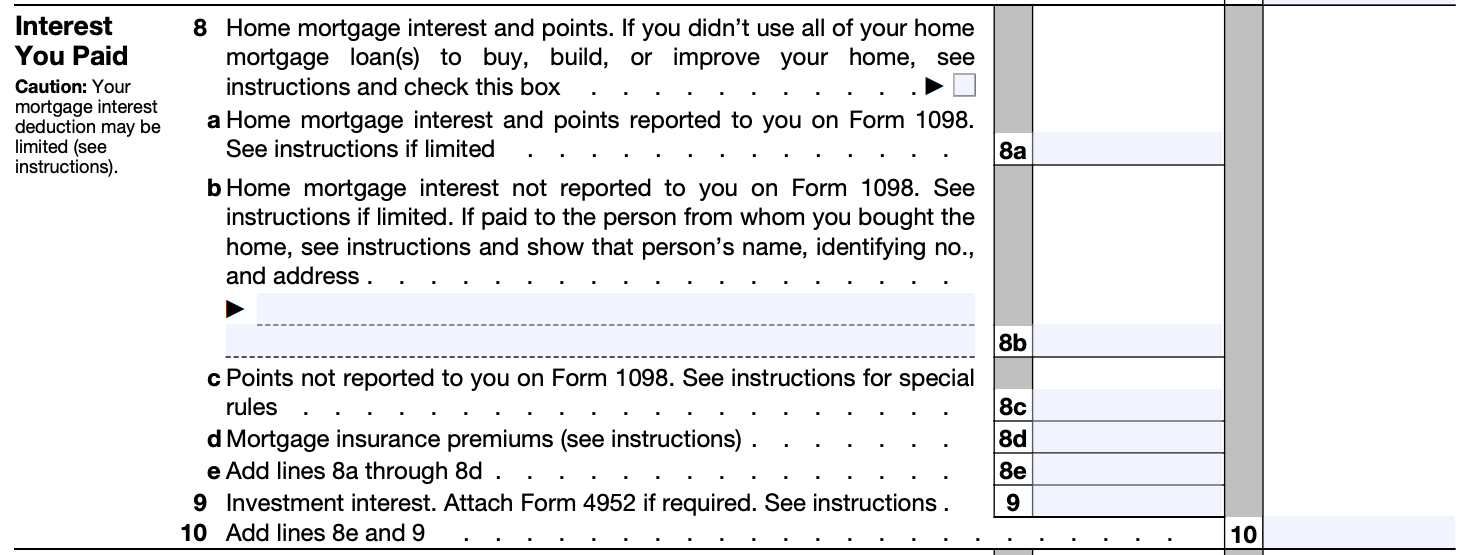

Choose Standard or Itemized Deductions. Include your Iowa Schedule A with your return. Web Itemized Deductions Interest Paid 2021 Interest That Is Deductible as an Itemized Deduction Home mortgage interest paid that is acquisition debt subject to.

Web tax returns with itemized deductions Internal Revenue Service 2022. Web 37 mortgage interest itemized deduction Jumat 17 Februari 2023 Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web Your itemized deductions might look something like this.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Taxpayers in the 37 tax bracket for. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt.

2000 Your total itemized. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web Frequently Asked Question Subcategories for Itemized Deductions Standard Deduction Autos Computers Electronic Devices Education Work-Related Expenses Gifts. Web If you itemize complete the Iowa Schedule A check the itemized box on line 37 and enter your total itemized deduction. Divide the cost of the.

Start with a quick assessment of your deductions for the year. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web How to Claim the Mortgage Interest Deduction 1.

Also you can deduct the points. Web Used to buy build or improve your main or second home and. Compare More Than Just Rates.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Find A Lender That Offers Great Service.

Step By Step Guide

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Rules Limits For 2023

Vacation Home Rentals And The Tcja Journal Of Accountancy

Itemized Deductions Full Report Tax Policy Center

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

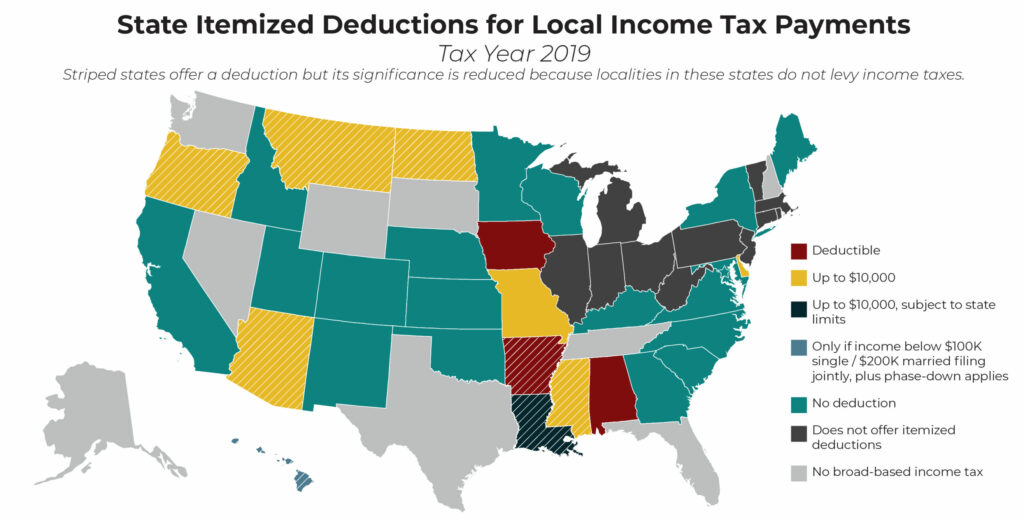

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction Bankrate

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

The Most Popular Itemized Deductions Tax Foundation

Mortgage Interest Deduction Bankrate

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

What Expenses Can Be Deducted From Capital Gains Tax

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022