27+ temporary buydown mortgage

Web Temporary subsidy buydown plans are a good fit for borrowers who have the capacity for higher earnings within a few years of obtaining a mortgage. The interest payments are reduced for the first few.

22 31 May Product Highlight Temporary Interest Rate Buydowns Pcg

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

. With a 3-2-1 buydown mortgage the borrower pays a lower interest rate. Web One of these options is what is known as a temporary buydown. Updated FHA Loan Requirements for 2023.

Compare More Than Just Rates. Temporary Buydowns allow buyers to. Affordable housing is the primary determinant of financial stability.

Web Learn about your mortgage payments with Envoy Mortgages mortgage payment and amortization calculators. Explore Quotes from Top Lenders All in One Place. Web Emergency due to COVID-19.

Discount points are paid to the lender in exchange for a lower rate. Web VA Home Loans are provided by private lenders such as banks and mortgage companies. Find A Lender That Offers Great Service.

Ad Compare the Best Home Loans for March 2023. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Check Your Official Eligibility Today. Web Heres what you should consider when it comes to a permanent mortgage buydown. Ad SCDHC can help you reach your goals.

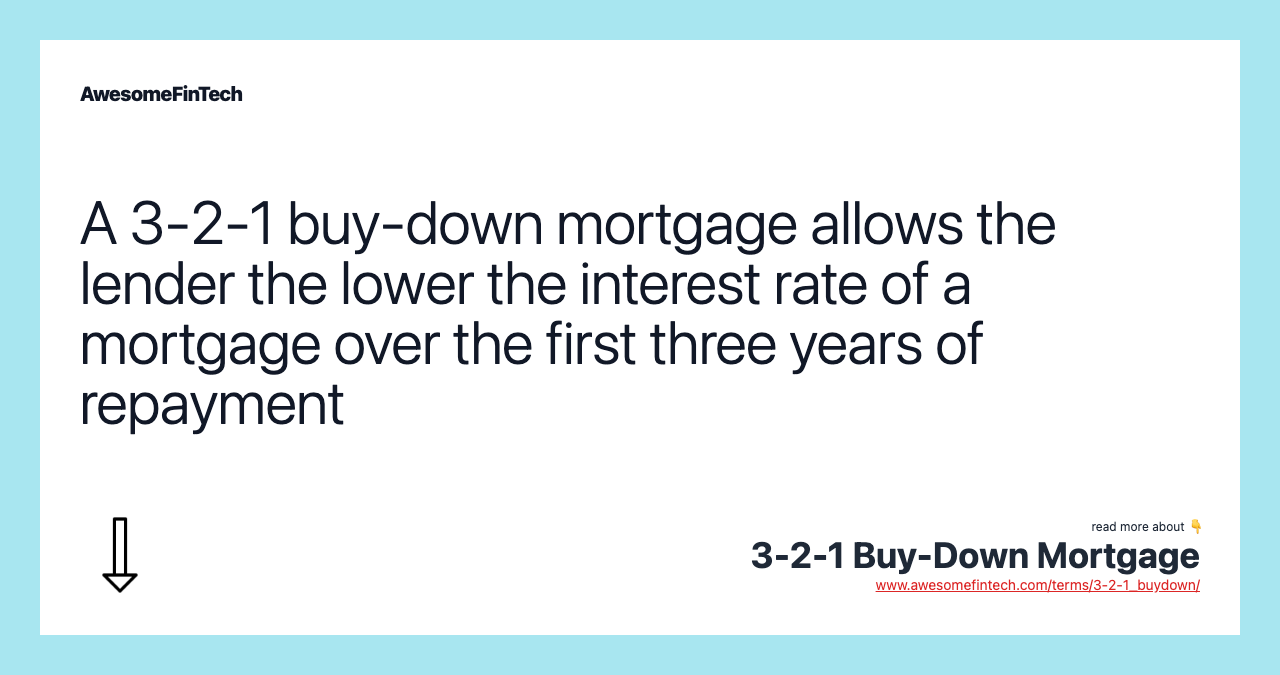

Compare Offers Side by Side with LendingTree. Apply Get Pre-Approved Today. Web The 3-2-1 Temporary Buydown Defined A mortgage buydown allows you to reduce the interest rate on the loan by paying additional cash up front during the closing process.

Web 5 hours agoFirst whats a rate buydown. Lock Your Rate Today. Web A temporary buydown or step-up mortgage is a home loan where the monthly payments start out relatively low and then gradually increase over time to a set fixed rate.

Web There are three common arrangements for temporary mortgage buydowns. The mortgage rate can be bought down to a lower number and for some borrowers the savings are. The points paid upfront reduce the interest rate by 1 for.

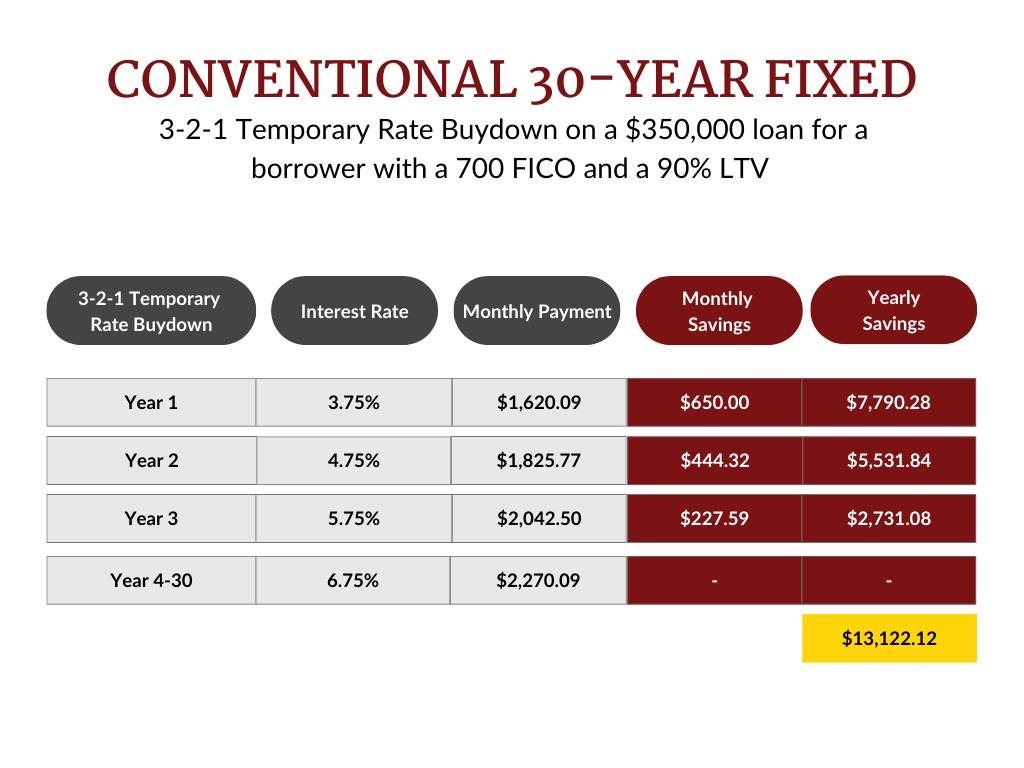

Web A 3-2-1 buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. This is a temporary reduction that allows you to get an interest rate that starts low and increases incrementally for the first three years. Return to Top of Page.

Ad Take the First Step Towards Your Dream Home See If You Qualify. 450000 Down payment. Web Common temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate.

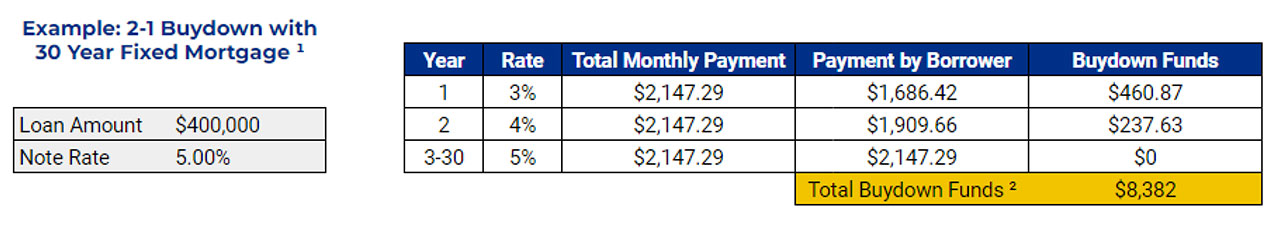

As the name suggests the. Web A 2-1 buydown is one kind of temporary buydown in this case lasting for two years. Web In a 2-1 temporary buydown the rate is bought down for the first two years of the mortgage loan.

A common temporary buydown is a 3-2-1 meaning the mortgage payment in years one. Web A buydown is a mortgage-financing technique where a buyer pays a lower interest rate either in the first few years of a mortgage loan temporary or over the. Calculate your rates today.

Web There are two types of mortgage buydowns. Web 3 hours agoCommon temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate. Check Your Official Eligibility Today.

On March 27 2020 VA published Circular 26-20-10 Lender Guidance for Borrowers Affected by COVID-19 to provide guidance to lenders regarding. Its exactly what it sounds like. Ad Get the Right Housing Loan for Your Needs.

A temporary buydown is where the borrower pays an upfront fee to reduce their interest rate for the. VA guarantees a portion of the loan enabling the lender to provide you with more. Temporarily reduce mortgage interest payments.

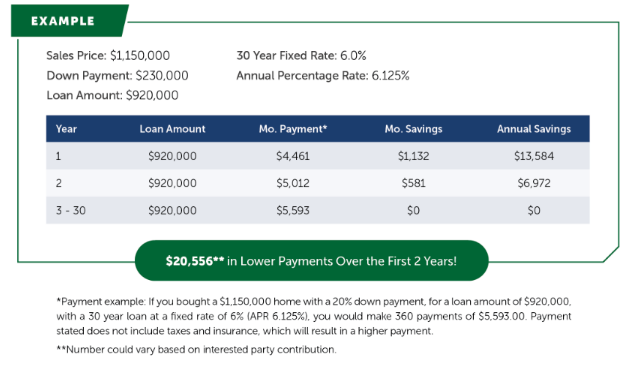

Web The 2-1 Temporary Buydown reduces the buyers interest rate by 2 for the first year of their loan and 1 for the second year. Web Permanent buydown with Temporary buydown mortgage loan options. A 3-2-1 buydown a 2-1 buydown and a 1-0 buydown Below is an.

Begin Your Loan Search Right Here. Web Basically a temporary buydown helps people qualify for mortgages due to a smaller initial monthly payment. For instance if the note rate is 5 then the rate is reduced to 3 for.

Web Refer to the Selling Guide for information on allowable sources of temporary buydown funds. Updated FHA Loan Requirements for 2023.

A D Mortgage Launches Temporary Rate Buydowns Ad Mortgage

Mortgage Loan Temporary Buydowns High Interest Rate 3 2 1 0

![]()

Temporary Interest Rate Buydowns Florida Capital Bank Mortgage

Buydowns Can Help Homebuyers In Rising Interest Rate Environments Envoy Mortgage

Temporary Rate Buydown New By Preferred Mortgage Corp

Offer Temporary Rate Buydowns For Increased Flexibility Uwm

O1ne Mortgage New Temporary Buydown A New Way To Help Facebook

How To Benefit From A 2 1 Temporary Buydown Realitycents

2 1 Buydown Intercap Lending

Blog Post Bankingbridge A New Standard In Mortgage Lead Conversion

3 2 1 Buy Down Mortgage Awesomefintech Blog

A D Mortgage Launches Temporary Rate Buydowns Nmp

The Buydown Loan How To Get A Lower Rate The First Couple Years On Your Mortgage The Truth About Mortgage

The Temporary Interest Rate Buydown The Secret Hack To Rising Mortgage Rates Cmg Financial

How A Temporary Rate Buydown Can Help Lower House Payments Orange County Register

Homebuying Made Affordable Mortgage Temporary Buydown Southstate Bank

Nmsi Inc National Mortgage Services